Alpha Portfolio Service Brochure

Game of drones

Last year the CMA issued a record number of licenses to fly small drones in the UK, which was up a staggering 80% on the previous year. However, this could well be exceeded in 2015 as a drone is apparently the must have Christmas gift this year. This could well create challenges in itself from privacy infringement to aircraft safety.

Besides leisure, drones are being used increasingly in a wide range of commercial applications, from utility companies checking power lines to farmers viewing crops. Meanwhile, in the USA, Facebook has built its own drone to bring internet connectivity to remote parts of the world. The drone, which has the wingspan of a Boeing 737 is designed to operate at 90,000 feet and remain airborne for up to 90 days.

In the UK, the Government wants to spend more of the defence budget on military drones to combat the IS threat.

Which got us thinking that while technology is constantly changing, it appears more so in the internet era. We are investors in a number of companies involved both directly and indirectly in the new technology growth markets such as electronic counter-terrorism warfare, cybercrime prevention and 3D printing. We don’t like ‘sky-blue’ products but we do like futuristic technology that is commercially viable.

What have we been watching?

Last week saw a fairly sharp sell-off as developed market equities succumbed to extreme volatility that had been largely limited to emerging markets. It was not a good week with many markets moving into correction territory, down 10% from their highs, and a number of emerging markets into outright bear markets.

Anxiety has largely stemmed from the health of the Chinese economy, and the implications for the wider emerging market space, particularly those commodity producers selling into China. Extreme currency market volatility has not helped, with last week seeing a further bout of emerging market currency weakness.

With many fund managers away on their summer holiday, stock market trading volumes and news flow remains thin and as such volatility may well be exaggerated but clearly the health of the world’s second largest economy is significant.

The other issue at the forefront of investors’ minds is whether the US Federal Reserve raises interest rates in September, the odds have unsurprisingly diminished markedly over the last week.

![]()

In the UK, the annual rate of CPI turned positive in July at 0.1% although declined by 0.2% on June. The core CPI increase year-on- year was 1.2% which might focus minds at the BoE. However, food and petrol prices are lower while factory gate prices appear to be under control, suggesting no rush to raise interest rates. Foreign exchanges appear to disagree with Sterling at a 7 year high on a trade weighted basis.

![]()

In the USA, the solid employment market is helping to maintain confidence in the housing market with the house builder confidence index at the highest level since 2005. Indeed, US housing starts are at an 8 year high. US inflation expectations fell to their lowest level this year reflecting lower oil prices and Chinese currency devaluation.

![]()

In Japan, export growth slowed in July reflecting the slowdown in growth of China and other parts of Asia.

![]()

In China, house prices rose for the third month in a row in response to targeted policy stimulus. Despite the PBoC’s public statement in recent days that the currency devaluation will be a one off adjustment, many investors continue to expect a further gradual devaluation.

Elsewhere, the number of emerging market countries whose currencies are being pummelled by markets continuing concerns about China’s slowdown and an imminent US interest rate rise, continues to grow. Besides Turkey, Malaysia and Taiwan, the Russian Rouble has fallen by 44% over the last year against the US Dollar.

Emerging market equity outflows so far this year are estimated to be $24bn. Indeed the outflows between 2013 and 2015 are estimated to have exceeded inflows in 2012, which were over $50bn. As some say, ‘markets are driven by fear and greed’.

![]()

WTI oil futures hit their lowest level since 2009 on concerns about continued over supply with potential Iranian oil production in the pipeline in conjunction with an economic slowdown in China. The oil market has now experienced eight consecutive weeks of losses, the longest run since 1986. This weakness has been a feature across the commodity markets and certainly gives some relief to growth concerns for the consuming economies.

The Shanghai market suffered further weakness today falling in excess of 8%, as hoped for actions from Chinese authorities failed to materialise over the weekend. The hope, and indeed the expectation, will be for these actions to be forthcoming in the near-term which in turn should help to allay some of the anxiety currently prevailing.

With the negative news flow from China and commodities in general, it is too easy to become depressed. However, while global investors may be fretting, it appears some company management teams are not and are taking advantage of turmoil in equity markets. M&A activity globally has surpassed $3trillion so far this year. We remain focused on businesses with strong free cash flow that are well placed to fund acquisitions, or might one day find a large predator attracted to their cash flow.

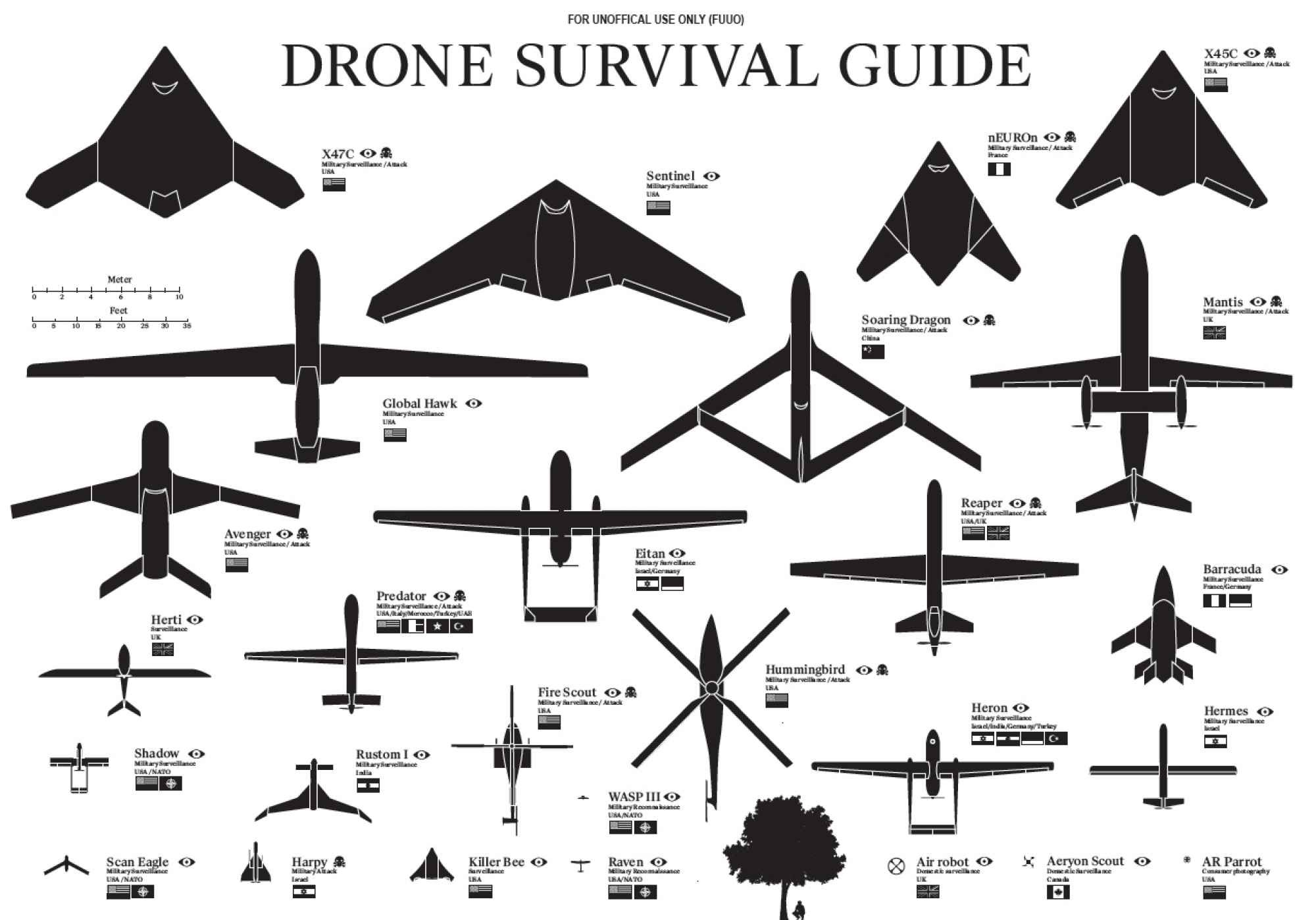

Finally, for those of you gazing skywards while led on a beach, we thought the following spotters guide to military drones might come in handy. Although come to think of it, by the time you spot a military drone, it is probably going to be too late to run away. One helpful hint – we think the man and tree are included to demonstrate scale as hiding beneath a tree doesn’t seem advisable should you ever happen to be pursued by a military drone!

Full version

© Alpha Portfolio Management 2024. All Rights Reserved

Site by Lookhappy