Alpha Portfolio Service Brochure

Regulation & Protection

INTRODUCTION

Alpha Portfolio Management (Alpha) takes its regulatory responsibilities very seriously. In the current climate it is only natural for intermediaries and clients to have questions about the security of their investments. We want to ensure that all stakeholders are entirely comfortable with the procedures that have been put in place both by our Regulator and ourselves before using Alpha’s portfolio management services.

Alpha Portfolio Management is a trading name of RC Brown Investment Management PLC (RCBIM). Whilst Alpha was only launched in January 2014, it is hopefully reassuring that RCBIM was established in 1990.

In this document we attempt to address some of the key questions that you may have regarding what is one of the most fundamental parts of our potential relationship with you. More detailed information on some of these areas are included in our Terms of Business, likewise details about the investor compensation scheme are available on the websites of;

Financial Services Compensation Scheme (FSCS)

Financial Conduct Authority (FCA):

HOW SAFE ARE INVESTMENTS HELD IN THE RCBIM’S NOMINEE SERVICE?

We see this covering three broad areas

- Our regulatory position

- The custody of client assets

- The custody of client cash

We trust that this covers the key considerations with regard to the security of client assets within RCBIM’s nominee service, however, if there is any more information that you would like to know, please contact us as we would be delighted to help.

OUR REGULATORY POSITION

Alpha Portfolio Management is a trading name of R C Brown Investment Management PLC (RCBIM), which is authorised and regulated by the Financial Conduct Authority (FCA). All client assets are held on Alpha’s behalf by RCBIM as the regulated entity.

RCBIM, as the regulated firm, is governed by the European Union Capital Requirements Directive, which establishes the regulatory capital framework with which FCA regulated investment firms must comply. It sets out the amount and nature of capital that must be maintained to ensure an adequate financial base and to provide security for investors. RCBIM is required to provide details of its capital position to the FCA on a quarterly basis in line with industry wide regulatory guidelines. RCBIM’s capital position as at 31st March 2023, its latest available financial year-end, showed a solvency ratio of 293% in excess of minimum regulatory capital requirement.

In common with our industry, the firm operates a nominee service. The FCA sets out the rules by which regulated firms that hold client assets and client money must operate to ensure its protection. We are required to report to the FCA monthly on client money and client assets.

Client assets held by the firm are held in the firm’s nominee company, RCBIM Nominees Limited. Sub-custodian arrangements are in place for the efficient administration and dealing of collective based investments and listed securities. In addition, all client money accounts have trust status, which is confirmed at the outset. This means that the money is ring-fenced by the bank, in the event of the firm’s insolvency.

The firm has robust systems and controls in place to ensure the firm and individuals comply with regulations. There are a range of controls to ensure the safety and protection of client money and assets, with no single individual having control of client cash. In addition, cash balances are reconciled on a daily basis.

The firm has Professional Indemnity Insurance in place in the event of a fraud, or significant client complaint. We consider this an important part of our commitment to protect client assets. We believe our insurance cover is adequate and appropriate for the business that the firm conducts and is regularly reviewed.

To offer additional comfort, RCBIM is a member of the Financial Services Compensation Scheme (FSCS). This means in the event of the firm’s default private clients will be eligible, within the rules of the scheme, to recoup some of their investments and/or cash. The FSCS provides protection for private clients of up to £85,000 for deposits, and up to £85,000 for investments, in the event that RCBIM could not repay or return client assets or private client money.

In the event of the firm becoming insolvent and having to cease trading the value of clients’ portfolios are protected by the FCA client asset and client money rules. An administrator will be appointed to identify the assets and liabilities of the firm and to ensure the correct separation of client assets from the assets of the firm. This usually allows clients to be repaid the full value of their investment portfolios relatively quickly. However, in the unlikely event that there is a shortfall in the total of client assets accounted for the FSCS will compensate clients for any loss up to the maxima for both client cash and assets. If the shortfall is greater than the FSCS upper limit public liability insurance is in place to cover the excess.

Separately, the Financial Ombudsman Service can impose a payment of up to £375,000 by the firm to a client where a client complaint has been upheld.

CUSTODY OF CLIENT ASSETS

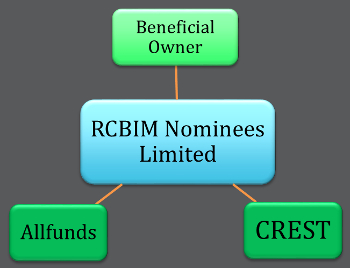

Client assets are held in RCBIM’s nominee company, RCBIM Nominees Limited.

In common with most other UK financial institutions which have nominee companies, RCBIM Nominees Limited is a non-trading company, formed solely for the purpose of holding assets on behalf of investors. It is completely ring-fenced from the company, being guaranteed by RCBIM’s primary bank, NatWest.

The nominee company holds assets in trust. This ensures the assets are carefully segregated from the assets of the company and remain client property at all times. Assets are subject to regular checking and reconciliation.

This pooling of assets improves efficiency and lowers administration costs whilst ensuring that in the event RCBIM defaulted, assets would not form part of the firm’s assets. Assets held by this nominee company cannot be pledged or used as collateral without the express instructions of the beneficial owners.

External approved custodians, which are used to hold client assets, are risk assessed prior to opening accounts and this risk assessment is reviewed annually. We use two principal sub-custodians to administer and deal in assets.

- CREST (Certificate-less Registry for Electronic Share Transfer) is the central securities depositary for the UK and Ireland. Almost every transaction in equities and Gilts conducted on the London Stock Exchange is conducted electronically using CREST to enable faster settlement. CREST is akin to a large messaging system, which conveys information about share trades and share ownership. The UK’s securities system, CREST, is operated by the Euroclear group the pre-eminent provider of post trade services to some 2,000 financial institutions in over 90 countries. The Bank of England supports the real time settlement process in CREST through the provision of intraday liquidity to the CREST settlement banks. All transactions in listed securities are reconciled through CREST on a daily basis.

- Collective based investments, principally unit trusts, are electronically administered through Allfunds Bank. This is one of the leading pan-European institutional platforms, with more than €1.4 trillion of assets under administration. It provides trading, settlement and custodianship for collective based investments.

Please see the illustration below:

CUSTODY OF CLIENT CASH

All client money accounts have trust status, which is confirmed at the outset. This means that the money is ring-fenced by the bank in the event of the RCBIM’s insolvency.

Client money may be pooled together and placed with leading FCA approved banks in an attempt to increase its security, as well as offer a rate of interest. Unlike many competitors, all interest generated on cash deposits is credited to client accounts, credited on a quarterly basis. UK interest will normally be paid gross.

All client money held by us shall be held in an account with banks who all have at least the equivalent cover to the Financial Services Compensation Scheme’s (FSCS) protection. In the event of a default of a bank or building society, clients have a claim to the account in general and not to a specific amount within the account. Client bank accounts are designated trust accounts and are segregated from our own funds and conducted in accordance with the FCA Client Money Rules, for the time being in force. Interest will be paid on the credit balance in accordance with The FCA Clients Money Rules.

We have a fiduciary duty to take good care of client cash and we take this responsibility very seriously. However, as stated in our Terms of Business (section 8 – Your Money) we cannot be responsible, or liable, in the event of default by any of the banks with whom deposits are placed.

COMPLAINTS

We have internal procedures for handling complaints fairly and promptly. In the first instance all complaints must be addressed to the Compliance Director at the firm’s registered address (a copy of our complaints procedure is available upon request). In certain circumstances, and subject to specific timeframes, if you are unhappy with our final response, or eight weeks have passed since we received the compliant you may refer your complaint to the Financial Ombudsman Service. For more information, please refer to the Financial Ombudsman Service, Exchange Tower, London E14 9SR. Tel. 0845 080 1800. Web: www.financial-ombudsman.org.uk.

We trust that this covers the key considerations with regard to the security of client assets within RCBIM’s nominee service, however, if there is any more information that you would like to know, please contact us as we would be delighted to help.

Full version

© Alpha Portfolio Management 2025. All Rights Reserved

Site by Lookhappy