Alpha Portfolio Service Brochure

Alpha Bites Special – Episode IV – A New Hope

A new, new beginning

And so, Chancellor Philip Hammond has entered and left the House of Commons bear pit. The most highly anticipated message from our ‘new’ administration has come and gone. Was it a statement or a budget? Did it reassure or confuse? Are you feeling over or underwhelmed?

At a headline level, somewhat predictably, there were few surprises. The new Chancellor isn’t someone that comes across as a man that likes to surprise people. Will he live up to his image as a ‘safe pair of hands’? As we enter a new economic era, we could certainly do with a calm and measured approach, to steering the UK and its fragile economy. So we are in a position to enjoy the opportunity that Brexit could present all of us.

Did he deliver? Balancing any pressure to provide fiscal stimulus with financial prudence, judging by the markets’ subsequent somewhat muted reaction, all things considered, not a bad first effort.

With most of the headline measures well leaked, the shift in financial policy was presented as more of a reset. Gone is George Osborne’s stricter fiscal framework, replaced by headline rules or benchmarks:

• Cyclically-adjusted, PSNB is to be reduced below 2% of GDP by 2020/21.

• Net debt as a percentage of GDP to be falling in 2020/21.

• Expenditure on welfare to be contained within a pre-determined cap.

The launch of the new National Productivity Investment Fund seems to have resonated pretty well and should act as a ‘Brexit’ buffer and provide a message of support both internally and globally, that we are a supportive, business friendly economy. However, the bottom line is an underlying theme of increased expenditure and not much in the way of tax revenue to fill the gap in the short term. Financing the nation’s debt, could become more troublesome as we suspect the short-term threats from Brexit are more likely to cause an undershoot on tax revenues and thereby put greater pressure on debt funding. Little to reassure the rather jittery Gilt market we have at present.

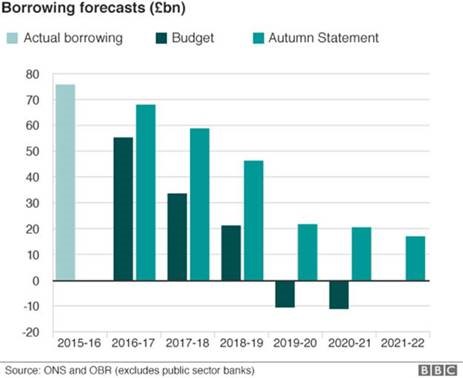

The Government’s shift in stance is best demonstrated by this graphic from the BBC.

Time will only tell if Philip Hammond is up to the task. But the one radical message is that we are going to be having an Autumn Budget followed by a Spring statement!

Further information about Alpha Portfolio Management, our products and services, please visit www.alpha-pm.co.uk or email info@alpha-pm.co.uk. Alternatively, you can call us on 0117 203 3460.

This publication is for informational purposes only and should not be relied upon. The opinions expressed here represent analysis by an Alpha Portfolio Management representative at the time of preparation and should not be interpreted as investment advice.

You should seek professional advice before making any investment decisions. The past is not necessarily a guide to future performance. The value of shares and the income from them can fall as well as rise and investors may get back less than they originally invested. The sender does not accept legal responsibility for any errors or omissions, in the context of this message, which arise as a result of internet transmission or as a result of changes made to this document after it was sent.

Alpha Portfolio Management is a trading name of R C Brown Investment Management PLC which is authorised and regulated by the FCA.

Registered Office: 1 The Square, Temple Quay, Bristol, BS1 6DG. Registered in England No. 2489639

Copyright © 2016 Alpha Portfolio Management, All rights reserved

Full version

© Alpha Portfolio Management 2025. All Rights Reserved

Site by Lookhappy