Alpha Portfolio Service Brochure

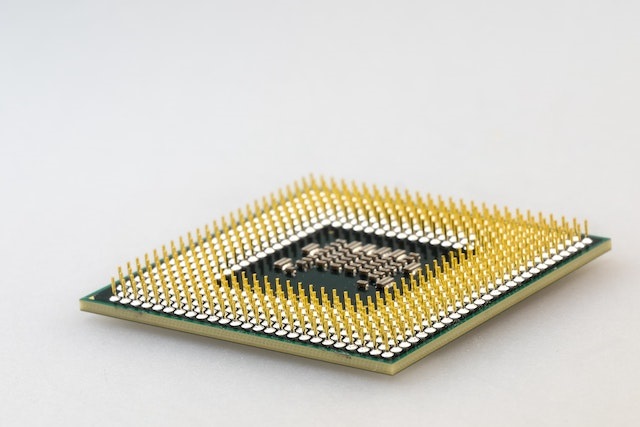

How do you like your chips?

As readers will be aware, we are mindful of the ongoing tension building between the US and China and the potential impact the rift could cause on global trade. Increasing tensions have given rise to a significant shift in US government defence priorities, from counter-insurgency operations (Afghanistan, Iraq) to equipping forces for potential peer-to-peer competition in the Pacific. This has resulted in a swift and unexpected re-prioritisation of US defence budgets.

The landmark AUKUS tri-lateral security pact between Australia, the UK and US announced at the end of 2021 to cover the Indo-Pacific region, was also a sign of this change in priorities. Under the pact, the US and UK will assist Australia in acquiring nuclear submarines. Australia has recently published its Defence Strategic Review which will see the biggest overhaul of Australian defence since World War II. This will involve £10bn of spending to deliver the report’s immediate recommendations including the acquisition of the US HIMARS system, as used successfully by Ukrainian armed forces as well as long-range anti-ship missiles. This announcement was not well received by the Chinese or indeed the French, which had their own multi-billion defence deal with the Australians scrapped.

In a range of retaliatory measures, China launched a national security review in April into US based Micron, one of the three leading suppliers in the $100Bn global DRAM-memory-chip market. Some 95% of the DRAM market is controlled by Micron and two other companies, South Korean Samsung and SK Hynix these have a combined 70% share of the market. Last week, South Korea’s president visited the US and President Joe Biden is reported to have urged him not to let his country’s chip-makers fill any market gap, if Beijing bans Micron from selling chips in China. Almost a quarter of Micron’s sales are estimated to be in China. The Micron case has emerged as a litmus test of whether Beijing is willing to take coercive economic measures against a major US company. This could develop into a tit-for-tat retaliation, given US measures against Chinese companies such as Huawei.

Reports suggest that relations between the US and China are as frosty as they have been in decades. Given recent Chinese war games and the heightened tensions across the Straits of Taiwan, then this is worrying. Last week, US Treasury Secretary Janet Yellen tried to appease China’s concerns, by saying that the US is not trying to undermine China’s economic competitiveness. US Secretary of State Anthony Blinken is not welcome in Beijing for cancelling his trip to China in February, due to the infamous spy balloon incident. Let us hope Janet Yellen’s comments may offer scope to re-engage in dialogue.

What have we been watching?

JP Morgan Chase has taken over the troubled regional bank First Republic in a deal brokered by US regulators. First Republic is the third US regional bank, after SVB and Signature Bank to go under. Can investors breathe a sigh of relief? Is this the beginning of the end of the global banking crisis or to quote Winston Churchill is it perhaps the ‘end of the beginning?’

While markets have been relatively calm in the wake of the banking crisis, investors remain concerned about the headwinds to global economic growth from tighter credit conditions. In addition, disappointing manufacturing activity data together with softer Chinese industrial production figures has seen commodity prices fall with both iron ore and copper dropping. Gas prices have also fallen, with the price in the UK almost half of its previous peak. While lower commodity prices reflect slowing economic growth, they should help reduce inflation and enable central banks to ease off on interest rate hikes. A lower oil price will also starve Russia of funds for its war in Ukraine. We get interest rate decisions from two central banks this week – the US Federal Reserve (Fed) and the European Central Bank.

The US Federal Reserve and its counterparts in the eurozone, UK, Canada, Japan, and Switzerland introduced daily dollar liquidity provisions in March in response to the developing banking crisis. These jointly announced that ‘In view of the improvements in US dollar funding conditions and the low demand at recent US dollar liquidity-providing operations’, that they had decided to ‘revert the frequency of their 7-day operations from daily to once a week.’ While this is re-assuring, the damage suffered by some of the US regional banks continued to be revealed with First Republic reporting it had suffered a $72bn outflow or a 40% drop in its deposits. Ouch!

Ukraine’s President Zelensky said he had a ‘long and meaningful’ phone call with China’s Xi Jinping, their first contact since Russia’s invasion.

![]()

In the UK, the British Retail Consortium (BRC) reported that food prices in supermarkets rose by 15.7% in the year to April. However, the BRC said ‘we should start to see food prices comes down in the coming months as the cut to wholesale prices and other cost pressures start to feed through.’ Meanwhile, UK house prices rose for the first time in eight months in April, halting the worst slump in 14-years.

![]()

The eurozone narrowly avoided recession in the first quarter of 2023 as Italy and Spain, the third and fourth biggest economies in the region performed better than expected. Milder winter weather, lower wholesale energy prices and China’s economy re-opening have all helped. The annual inflation rate in the eurozone dropped sharply in march from 8.5% to 6.9% but the core inflation which excludes food and energy touched a new high of 5.7%.

![]()

The US debt ceiling is rearing its head once again and is likely to generate plenty of headlines in the weeks ahead. The US hit its borrowing ceiling of $31.4trillion in January, but if the limit is not raised before current tools are exhausted, the US government risks defaulting on payment obligations as early as July. Meanwhile, US consumer confidence hit a nine-month low with many economists retaining their belief that the US will move into recession in 2023. The latest core personal consumption expenditure (PCE) index, the Fed’s preferred inflation measure came in broadly in line with expectations but was up very slightly at 4.9%.

![]()

The new head of the Bank of Japan backed the current monetary policy stance saying that there is currently no evidence of ‘runaway inflation.’

![]()

In China, the property market remains weak with new home sales falling. Meanwhile, the China Iron & Steel Association which represents the country’s leading producers has warned that the sustained and rapid fall in steel prices in China is posing severe challenges. The price of iron ore dropped on this news last week.

![]()

Brent oil dropped to $79. The market appears surprised that OPEC+ production cuts have failed to support the oil price. Concerns about global oil demand remain and perhaps China and India are awash with cheap Russian oil?

Finally, did you receive the UK Emergency Alert last Sunday at 3pm? I did but was a bit alarmed to discover that the government ‘boffins’ had chosen what sounded to me like Thomas the Tank engine to notify us. A submarine crash dive or anti-collision siren would surely have been more appropriate? However, the government has confirmed that one in five phones did not receive the alert and may ‘conduct further operational testing’ at some point.

Read Last Week’s Alpha Bites – Bailouts on the Belt and Road

Further information about Alpha Portfolio Management, our products and services, please visit www.alpha-pm.co.uk or email info@alpha-pm.co.uk. Alternatively, you can call us on 0117 203 3460.

This publication is for informational purposes only and should not be relied upon. The opinions expressed here represent analysis by an Alpha Portfolio Management representative at the time of preparation and should not be interpreted as investment advice.

You should seek professional advice before making any investment decisions. The past is not necessarily a guide to future performance. The value of shares and the income from them can fall as well as rise and investors may get back less than they originally invested. The sender does not accept legal responsibility for any errors or omissions, in the context of this message, which arise as a result of internet transmission or as a result of changes made to this document after it was sent.

Alpha Portfolio Management is a trading name of R C Brown Investment Management PLC which is authorised and regulated by the FCA.

Registered Office: 1 The Square, Temple Quay, Bristol, BS1 6DG. Registered in England No. 2489639

Copyright © 2021 Alpha Portfolio Management, All rights reserved

Full version

© Alpha Portfolio Management 2025. All Rights Reserved

Site by Lookhappy