Alpha Portfolio Service Brochure

The Great British Investment Opportunity

Potentially a ‘once in a lifetime’ event

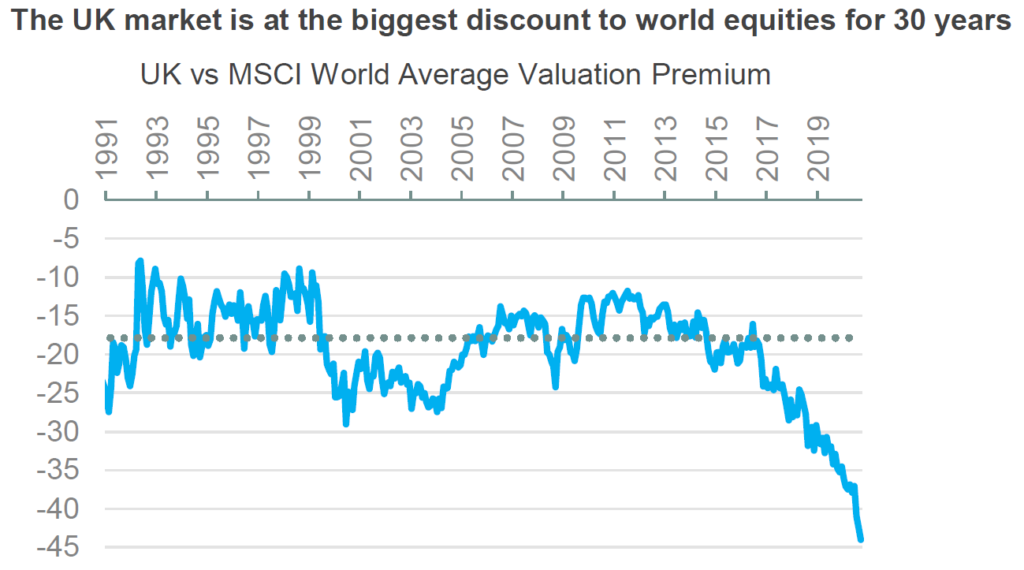

The UK stock market is hugely out of favour reflecting a number of factors including Brexit, the economic impact of Covid-19 and its higher exposure to sectors with a more cyclical bias. These have left the index trading near a multi-decade valuation discount when compared to global peers. Analysis by JP Morgan notes that the last two occurrences of this saw the market materially outperform peers in the following 12 months.

The following chart highlights the extreme divergence, but also the potential longer-term investment opportunity as market performance reverses:

Brexit

An obvious trigger for a reversal of this underperformance could be some kind of resolution to Brexit negotiations. This would allow UK businesses and those investing capital from overseas to plan for the future. Whilst we would acknowledge that we may see extreme highs and lows in sentiment as negotiations progress over the next few months, the potential reversal should be apparent from the start of 2021. With the current discount standing at around 45%, compared to its average of around 20% over the past 30 years, a reversal of this trend should lead to material outperformance.

From a global perspective, uncertainty around the future relationship with the EU has plagued us for some years now. The coming months should provide clarity on this issue and will allow the UK to become an investable asset class again. The extremely attractive valuations, coupled with the composition of the UK market, should see it benefit from a rotation away from highly valued areas elsewhere in the world. Although the UK lacks a meaningful stock market technology sector, it still offers investors exposure to both high quality, growth companies as well as companies whose outlooks are fundamentally undervalued.

US Election risk

Trump remains a loose cannon. We believe that political uncertainty elsewhere in the world, but particularly in the US given the possibility of a change in leadership or a contested election result, is not yet reflected in US markets.

Value versus Growth

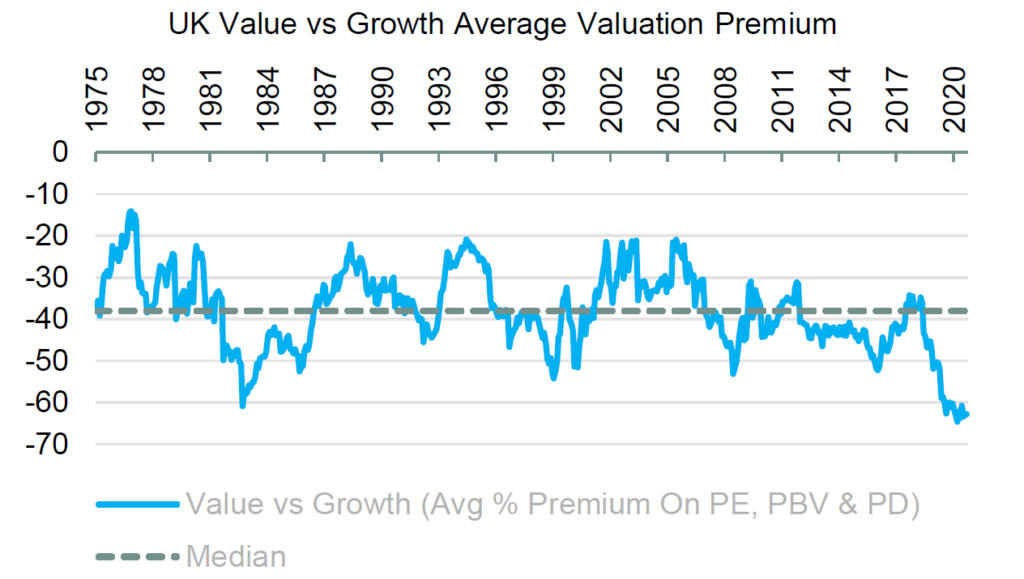

Even within the UK equity market, there has been a significant divergence in valuations between factors such as value and growth. The following chart highlights this disparity:

The recent divergence is partially explained by the dramatic fall in interest rates and bond yields. Whilst companies categorised as value are generally priced for recessionary conditions, in contrast, companies labelled as growth tend to have far more optimistic outlooks. This is unsustainable and we would anticipate the outcome being somewhere between these two extremes. This would put pressure on the growth areas of the market, but would increase the recovery potential of value if any kind of normalisation in economic conditions were to occur, let alone the prospect of an economic recovery. This potential outperformance of value would stem from two factors:

- an overdue expansion in valuation multiples,

- a series of earnings upgrades as analyst’s reverse some of their most pessimistic assumptions.

Covid-19 has clearly impacted UK dividend policy. Historically the UK has offered investors a higher dividend. The gradual normalisation of divided policy is a further catalyst, bearing in mind interest rates are almost zero and are unlikely to increase for a number of years. Any move to negative interest rates is likely to increase investor appeal.

Coronavirus. Extreme valuations to reset at the end of the pandemic

Rising Covid-19 cases and restrictions on economic activity remains a concern. However, this is a global problem with significant resources being focussed toward treatment, vaccines and testing. Areas of the market, such as US tech, rely on strong growth to sustain current valuations and have been significant beneficiaries of lockdown measures, we do not believe the prospect of a vaccine or the implications of a broad economic recovery are priced into equity markets. With over 150 vaccines currently being trialled, the medical community has indicated it could be a matter of months, rather than years, before one or more of these might be viable candidates.

Finally, we would also highlight that a number of large fund management groups are in the process of launching new, UK stock market focussed funds. This in combination with large global investment banks turning more positive on the UK provides further reassurance in the outlook for the UK stock market, and as has been noted elsewhere, the possibility that this could well be a ‘once in a lifetime’ opportunity.

This article is not personal advice. If you are not sure of the suitability of any investment, you should seek independent financial advice. If you choose to invest, the value of your investment will rise and fall, so you could get back less than you put in. We believe that stock market investments should always be made only for the long term (i.e. more than 5 years). Unless otherwise stated, the source of statistical and other data is Alpha Portfolio Management.

Alpha Portfolio Management is a trading name of R C Brown Investment Management PLC. R C Brown Investment Management PLC is authorised and regulated by the Financial Conduct Authority (registration number 146002). Registered in England and Wales (No. 2489639) at 1 The Square, Temple Quay, Bristol BS1 6DG.

Full version

© Alpha Portfolio Management 2025. All Rights Reserved

Site by Lookhappy